Understand your startup compensation, incl. stock options

This one's for everyone trying to understand the complicated European startup compensation packages, including the most confusing part of it all - VSOP.

In a previous issue, I shared strategies to prepare for a salary negotiation, including salary benchmarks for European startups. However, salary is only part of the compensation package (although a very tangible part). What are you getting out of this entire deal? In this issue, let’s talk about the most common components — salary and stock options.

Salary

Your salary could consist of a base, sometimes a bonus. Sales (including SDR, Account Executive, Account Manager, Customer Success Manager) and recruiting jobs will almost always have a bonus, simply because of the direct revenue and productivity impact that are easily measured by number of deals/candidates closed.

The rest — depends on the company size and stage. For example, in this anonymous Berlin Salaries Google Sheet with 233 entries that has been circling around, companies with 1500-5000 employees had the most number of non-sales/recruiting people (13, I counted) with a bonus. Although contrary to my expectation, companies with 50-150 employees followed next, with 9 non-sales/recruiting people reporting to have a bonus. This could be that companies at this size are experiencing the fastest growth, most likely raised their Series A.

What you might want to find out here: how is bonus paid out? Is it at the end of every month, every quarter, or every half year? What’s the bonus based on, personal performance or company revenue? How much of the bonus can an employee in your position typically receive? It could be that the bonus seems really high, but in reality you’ll have to try super hard to receive 100% bonus.

Tax: For those of you who live in Germany, use this tax calculator to find out how much money you’ll actually take home from your total salary. This can help you decide how much to ask for in salary negotiations, raise and promotion discussions. A few thousand increase might only land you a small increase in net monthly salary.

Stock options

Okay here we go: this is probably the most complicated part of your compensation package. I’m not a financial expert, so this is not expert financial advice but my findings from the employee stock option research.

Stock options are used by startups to motivate employees to contribute to the company’s growth. For those of you living in Germany, here’s the bad news: most startups offer what’s called a VSOP (virtual stock option plan), which in essence, means that you won’t get money until the company gets sold or goes public (IPO). High-Tech SeedLab explained in an article:

In Germany, receiving shares as a non-founder (not being a natural shareholder from the get go) can impose a major tax burden.

This issue was also covered by Sited.eu:

Employees are taxed the moment they are granted stock options, not when cash actually hits their accounts. “Stock options are taxed instantly like salary. There is no liquidity to an employee,” Samios says.

“You’re taxed on an income that you don’t actually have in your bank account. That’s actually the single most important reason that there are just no options at all in Germany,” according to Vollmann, who adds that employees can also be taxed much higher than founders who have equity.

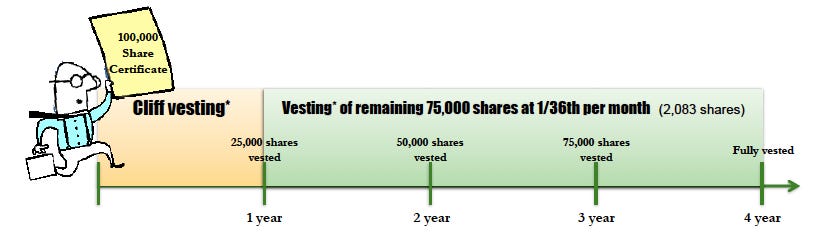

High-Tech SeedLab also gave an example of a typical stock option plan:

In simple words, this plan is saying that you won’t get any shares until you’ve stayed at the company for at least 1 year (vesting cliff). Then your number of shares will increase each year. When you go into a compensation conversation with a future employer, make sure they can explain their stock option plan to you crystal clear.

So what’s the point of getting stock options then? Well, if you join a promising startup at the right time, you might just become a millionaire, like the 500 employees at Freshworks, as the company just had its IPO at Nasdaq this week. You could also look out for Germany’s next Trivago, Zalando, or Hellofresh, as long as they’re not like Mailchimp here which were sold to Intuit for $12 billion while giving no equity to employees.

Happy mathing — I mean, making money!